623

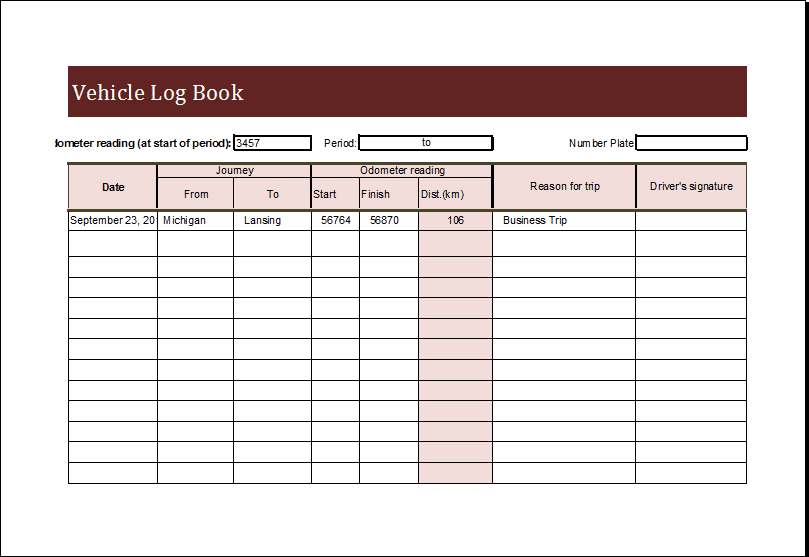

You can easily keep your logbook with Microsoft Excel – there are numerous templates on the Internet that you can download

Here you can get logbook templates for Excel

If you use a company car – whether you are self-employed or an employee – you probably also use the car privately. As a rule, you must declare this non-cash benefit on your tax return. It is helpful to keep a logbook for tax purposes.

- Use a logbook to record all journeys. You can either buy a paper logbook or use Excel templates from the Internet.

- In our download area you will find an excellent Excel template for a logbook. You can use the logbook template from our download area with all Excel versions.

- Microsoft also provides you with free logbook templates. These are usually 100 percent fully customizable templates.

- A somewhat more detailed logbook is available free of charge from Exel-Vorlagen.net.

- For a complete driving record, you can also use the logbook template from vorlage-kostenlos.de.

Strict guidelines for logbooks

There are guidelines for keeping a logbook that have been laid down by the Federal Ministry of Finance. These should be strictly adhered to.

- First of all: Every vehicle needs its own logbook. If the vehicle is driven by several people, it is essential that you enter the name of the driver for each journey

- In accordance with Section 8 (2) EStG, you must enter the date and mileage at the beginning and end of the journey when entering business trips. The kilometers of the route taken must also be entered as accurately as possible, as well as the destination and the reason for the journey. For private journeys, the start and end odometer readings are sufficient as information in the logbook.

- You must enter every journey in the logbook, including routine journeys that you make every day, for example.

- It is recommended that you enter the details of a journey in the logbook immediately afterwards and not a few days later.

- Important: You may only submit logbooks to the tax office in closed, unalterable form. Loose sheets are not permitted, but a bound or stapled book is. You can forward the logbook to the tax office digitally using certain logbook apps. It is important to note that subsequent changes are not technically possible